Tax Credit Opportunities

Give To Receive state tax credits!

Looking for ways to defer state taxes and give to Wildheart and our efforts to impact Allison Hill?

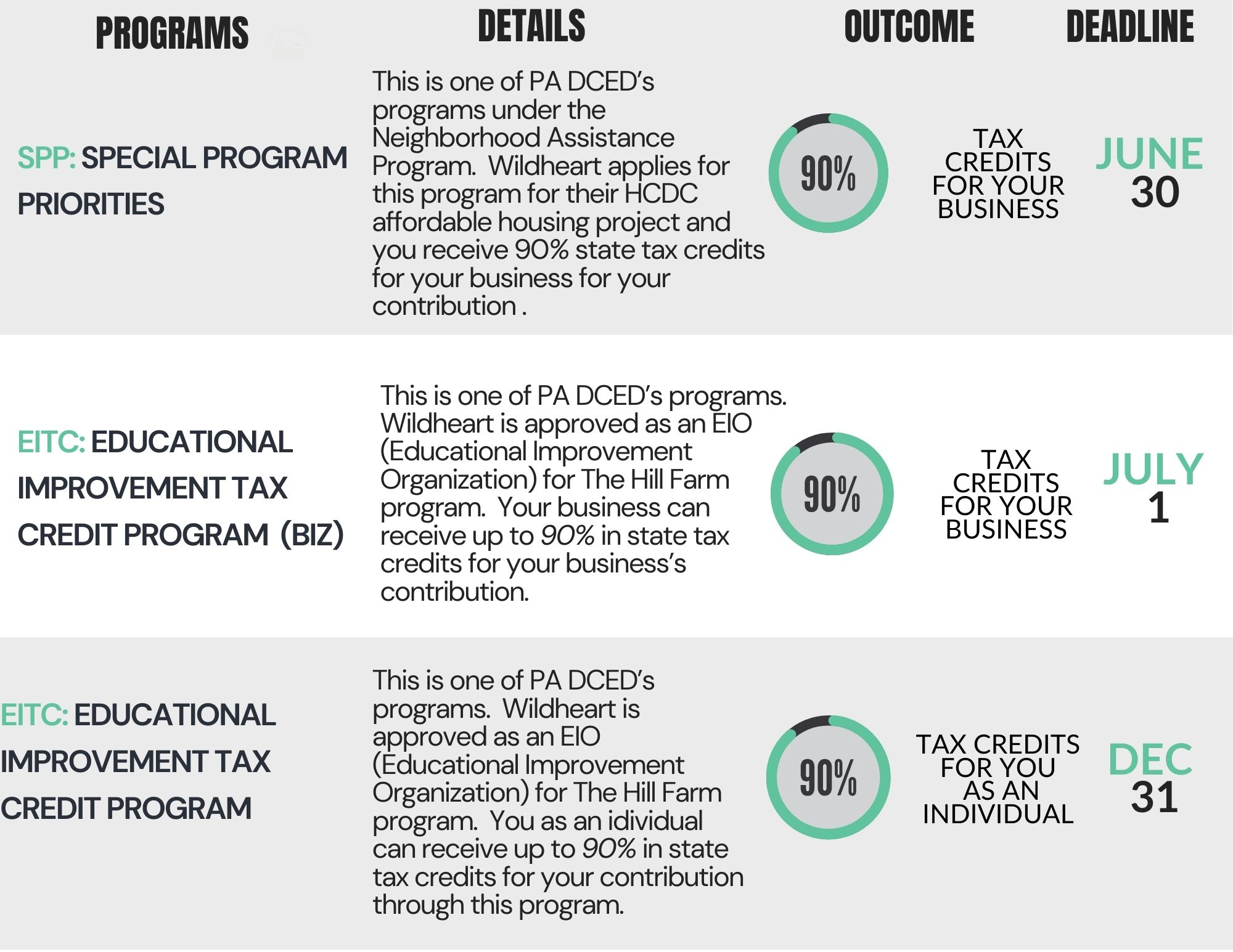

- SPP: SPECIAL PROGRAM PRIORITIES: This is one of PA DCED’s programs under the Neighborhood Assistance Program. Wildheart applies for this program for their HCDC affordable housing project and you receive 90% state tax credits for your business for your contribution.

- DEADLINE: JUNE 30TH

- EITC: EDUCATIONAL IMPROVEMENT TAX CREDIT PROGRAM (BIZ): This is one of PA DCED’s programs. Wildheart is approved as an EIO (Educational Improvement Organization) for The Hill Farm program. Your business can receive up to 90% in state tax credits for your business’s contribution. DEADLINE: JULY 1ST

- EITC: EDUCATIONAL IMPROVEMENT TAX CREDIT PROGRAM (INDIVIDUAL): This is one of PA DCED’s programs. Wildheart is approved as an EIO (Educational Improvement Organization) for The Hill Farm program. You as an individual can receive up to 90% in state tax credits for your contribution through this program. DEADLINE: DECEMBER 31ST

Click HERE for more information!